Stay Ahead of the Game: Adapting to Market Themes in Trading

Success in trading often depends on your ability to adapt. Like successful businesses create new products to meet customer needs, successful traders adjust to changing market trends. They learn to recognize patterns across different assets and time frames, helping them understand and predict market themes. In this article, we’ll explain market themes, how to identify […]

Weekly High-Impact Event News: Thanksgiving Special

Thanksgiving is a special time in the United States. It is a time for family gatherings and celebrations. But for traders, it’s also an important week in the financial markets. Thanksgiving happens on Thursday, and markets are closed that day. On Friday, trading hours are shorter than usual. These changes may affect trading volumes, and […]

Weekly Technical & Fundamental Analysis: 25/11/24

Staying ahead in the financial markets requires a clear understanding of technical and fundamental trends. This week’s comprehensive analysis covers the USD/JPY, EUR/USD, and XAU/USD pairs, offering actionable insights and trade ideas. Additionally, we explore economic data and central bank actions shaping global markets. Let’s dive into the week’s key levels, trend projections, and market […]

Weekly High-Impact Market Events: Key Insights for Savvy Traders

Understanding the significance of high-impact market events can make or break your trading strategy. This week offers a packed schedule, with critical events like the G20 Meetings, speeches from crucial FOMC members, the release of U.S. unemployment claims, and Flash PMI numbers. Each of these events has the potential to sway market sentiment, presenting traders […]

Technical & Fundamental Analysis: Insights and Opportunities

In the ever-evolving world of forex trading and commodities, staying informed is key to successful trading decisions. Vestrado is committed to providing in-depth technical and fundamental analyses to help you navigate the markets effectively. This week’s analysis covers crucial currency pairs and gold, offering insights into potential market movements and economic factors influencing them. Weekly […]

Weekly Fundamental Analysis: Key Global Economic Developments and Market Insights

Understanding global economic trends is crucial for traders looking to make informed decisions. This week’s fundamental analysis focuses on critical updates from Japan, Australia, the Eurozone, the United Kingdom, Canada, and the United States. These insights can help you anticipate market movements and optimize your trading strategy, whether you’re trading forex, commodities, or indices. For […]

Managing Foreign Exchange Volatility During US Election 2024

The forex (foreign exchange) market is one of the world’s busiest financial markets, and it often reacts to significant political events like the US presidential election. This year’s 2024 US Election could bring a lot of forex currency volatility, especially for currency pairs involving the US dollar (USD). Changes in economic policies and uncertain times […]

Top Trading Strategies to Manage Risk During the US Election 2024

The US election 2024 is just around the corner, and if there’s one thing we know, election times can make the stock market unpredictable. The potential for policy changes, taxes, and international relations can make markets go up and down unexpectedly. For traders, managing risk is essential to avoid significant losses and maximize opportunities. This […]

How the US Election 2024 Could Affect the Stock Market

The 2024 US presidential election is more than just a political event—it can cause changes in the stock market. Investors closely watch elections because new policies from a future president can impact the economy. This guide explains how the US election can affect stock prices, which sectors may be impacted, and what investors should know […]

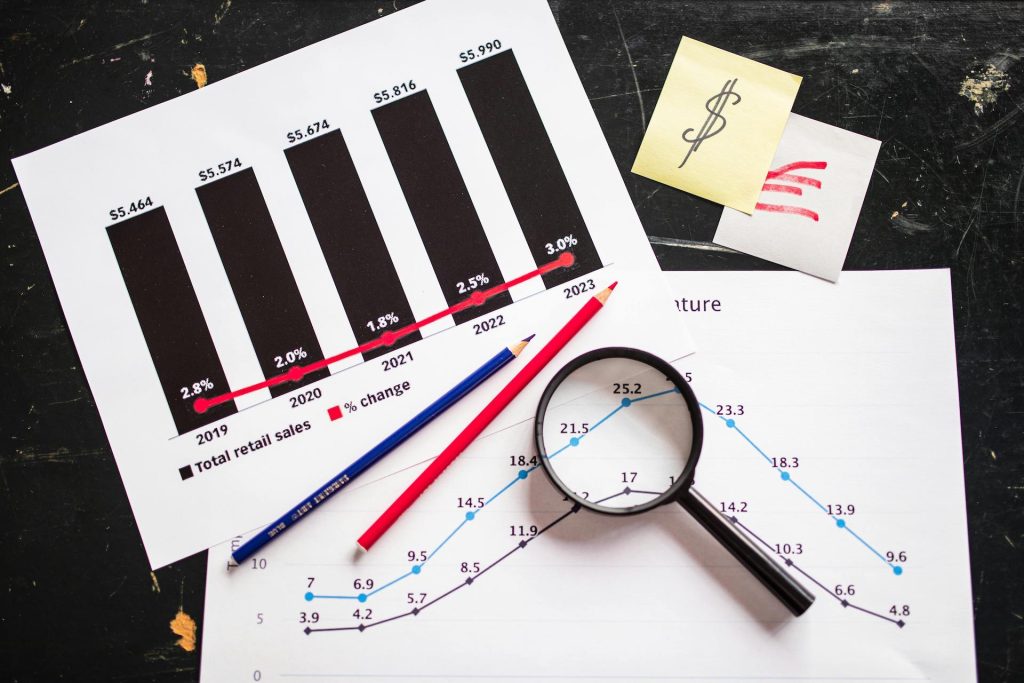

Weekly High Impact Economic Events: Retail Sales, FOMC, and Unemployment Claims Analysis

Economic events and indicators play a crucial role in shaping the financial markets. Traders and investors closely monitor these events, often resulting in significant price movements. This article explores three high-impact economic events expected this week: Retail Sales, the Federal Open Market Committee (FOMC) rate decision, and Unemployment Claims. Understanding how these factors interact can […]