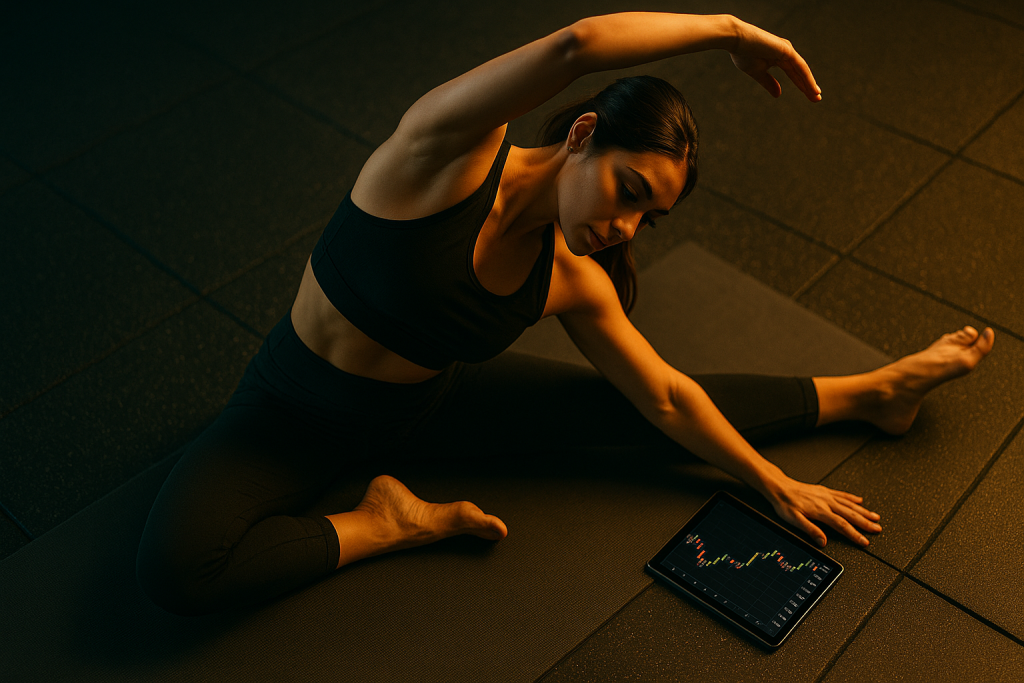

3 Ways a Healthy Body Can Give You an Edge in Trading

In the fast-paced world of forex trading, every small edge counts. While many traders focus heavily on strategies, indicators, and news, they often overlook one critical asset: their body. Staying physically and mentally healthy isn’t just good for general well-being; it’s a hidden weapon that can elevate your performance and decision-making. Here are three simple […]

Weekly Fundamental and Market Sentiment Analysis (27 May 2025)

Trading forex isn’t just about charts and indicators—it’s also about understanding what’s moving the market this week. Here’s a look at how the fundamentals are shaping the behavior of major currencies, from the US dollar to the Aussie. This overview helps traders like you on Vestrado make smarter, more confident trading decisions. USD: Delay in […]

What Are Moving Averages in Trading?

Moving averages (MA) are among the most popular technical indicators used by traders to analyze price trends and make better trading decisions. Whether you’re new to forex, stocks, or crypto trading, understanding moving averages can give you an edge by helping you identify the direction of the market more clearly. This guide breaks down what […]

How to Use Fibonacci to Place Your Stop So You Lose Less Money

Losing money in trading is painful, especially when you know the market eventually moves in your direction but only after hitting your stop loss. This is why knowing where to place your stop is just as important as choosing where to enter or take profit. In this article, we’ll show you two simple methods to […]

5 Useful Tips for Surviving a Market Crash

Practical Strategies for Vestrado Traders During Uncertain Times When markets tumble, fear spreads fast. Staying calm is tough when headlines scream “crash” and charts bleed red. But if you’re trading with Vestrado or planning to start, knowing how to survive a market crash can help you protect your funds—and maybe even profit from the chaos. […]

Weekly High Impact News: PMI & Jobless Claims Take the Spotlight

When you’re trading the markets, knowing what’s moving prices is just as important as knowing how to trade. This week, traders are turning their attention to key economic activity indicators—specifically, Jobless Claims and PMI (Purchasing Managers’ Index) reports. These two events will tell us whether the U.S. economy is still going strong or showing signs […]

How to Use Fibonacci Extensions to Know When to Take Profit

Fibonacci extensions are tools used by traders to find possible profit-taking levels during a trend. When a market is moving strongly up or down, these levels help predict where the price might pause or reverse. These levels are not random. They are based on mathematical ratios: 38.2%, 50.0%, 61.8%, 100%, 161.8%, and more. Many traders […]

5 Reasons You’re Missing Out on Winning Trade Setups

It’s frustrating when you watch a winning trade idea unfold exactly as you predicted, but you’re not in the trade. You saw the signs. You studied the asset. You even had a plan. But at the last minute, you hesitated. You waited too long. Or you placed your entry too far from the prize. And […]

Weekly High Impact Events: CPI, Retail Sales & Powell’s Speech

Financial markets can change direction fast, especially when important news drops. This week, three big events could move prices: the U.S. inflation report (CPI), retail sales data, and a speech by Federal Reserve Chair Jerome Powell. If you’re a trader, this is a week to watch carefully. And if you’re using Vestrado, you’re already ahead […]

4 Questions To Ask Yourself Before Chasing a Big Move in Forex

In 2025, financial markets are moving fast. We’ve seen huge price swings and strong rallies. It’s tempting to jump in and try to catch those big moves. But here’s the truth: not every big move is worth chasing. Before you open a trade, it’s smart to pause and ask yourself some simple but powerful questions. […]