Staying informed about market trends is crucial for traders looking to make better financial decisions. This report provides an overview of the latest fundamental and technical analysis for key forex pairs and gold. We examine the impact of economic events, central bank policies, and price movements to help you stay ahead in your trading strategy.

Fundamental Analysis: Key Currencies

Fundamental analysis examines the underlying economic factors that drive currency movements. Interest rates, inflation, political stability, and global trade policies all shape the forex market. Below is an overview of how significant currencies perform based on current economic conditions.

AUD (Australian Dollar)

The Australian dollar has experienced significant volatility due to economic and political factors. Recently, it hit a five-year low before making a partial recovery.

In early February, the threat of US tariffs pushed the Australian dollar to a five-year low below $0.6100. It later recovered to $0.6400 on February 21 before facing more pressure.

The Reserve Bank of Australia (RBA) began its rate-cut cycle by reducing rates by 25 basis points on February 18. However, the market expects further rate cuts of 60 bps throughout the year. With national elections approaching before May 17, political uncertainty could also influence the AUD in the coming months.

JPY (Japanese Yen)

The Japanese yen has been strengthening against the US dollar, driven by changes in interest rates and inflation trends.

A combination of lower US interest rates and rising Japanese bond yields helped strengthen the yen by over 3% in February. The USD/JPY peaked at JPY159 on January 10 before dropping to JPY148.55 by the end of February.

The Bank of Japan (BOJ) is committed to normalizing monetary policy, with a possible rate hike expected in Q4 2025. Japan’s inflation reached 4% in January, higher than the US inflation rate of 3%, signaling further adjustments in BOJ policy.

EUR (Euro)

The euro has shown mixed performance, responding to economic shifts in Europe and external pressures such as US trade policies.

The euro dropped to $1.0140 in early February before rebounding near $1.0535 following weak US retail sales data. However, renewed US tariff threats and recession risks in Europe could lead to further weakness.

The European Central Bank (ECB) is expected to cut interest rates by 25 bps in March, with another cut likely before the end of Q2 2025. The market expects the ECB’s deposit rate to drop from 2.75% to around 1.80% by year-end.

GBP (British Pound)

The British pound has gained strength in recent weeks, but its upward momentum may be fading as the market anticipates future rate cuts.

Sterling recovered from $1.21 in January to nearly $1.2715 on February 26. However, this rally may have peaked, with potential corrections toward $1.2300 – $1.2400 in the coming weeks.

The Bank of England is unlikely to cut interest rates at its March 20 meeting, but expectations for a rate cut in May 2025 are increasing. With strong wage growth and core inflation, markets anticipate two rate cuts in the year’s second half.

CAD (Canadian Dollar)

The Canadian dollar remains under pressure due to external trade policies and anticipated interest rate decisions by the Bank of Canada.

USD/CAD spiked to CAD1.48 in early February before falling to CAD1.4150 after US tariff delays. However, the CAD remains vulnerable to new risks, including potential 25% tariffs on Canadian exports starting March 4.

The Bank of Canada meets on March 12, with a 50% chance of a rate cut, while a full cut is expected in April. Markets are pricing in at least two rate cuts in 2025, with a possible third cut depending on economic conditions.

USD (US Dollar)

The US dollar has faced ups and downs recently, influenced by interest rate movements, trade policies, and economic growth concerns.

After strengthening in Q4 2024, the US dollar faced pressure in February before rebounding. The Dollar Index surged after renewed tariff threats against Canada and Mexico at the end of February.

Falling US interest rates remain a key factor. The 2-year US Treasury yield dropped below 4% for the first time in four months, while the 10-year yield fell to 4.20%. Traders are also monitoring the March 15 debt ceiling deadline, which could lead to a government shutdown if not resolved.

Weekly Technical Analysis: Trading Opportunities

Technical analysis helps traders identify potential price movements based on past trends and key market levels. Below are the latest insights for major trading pairs and gold.

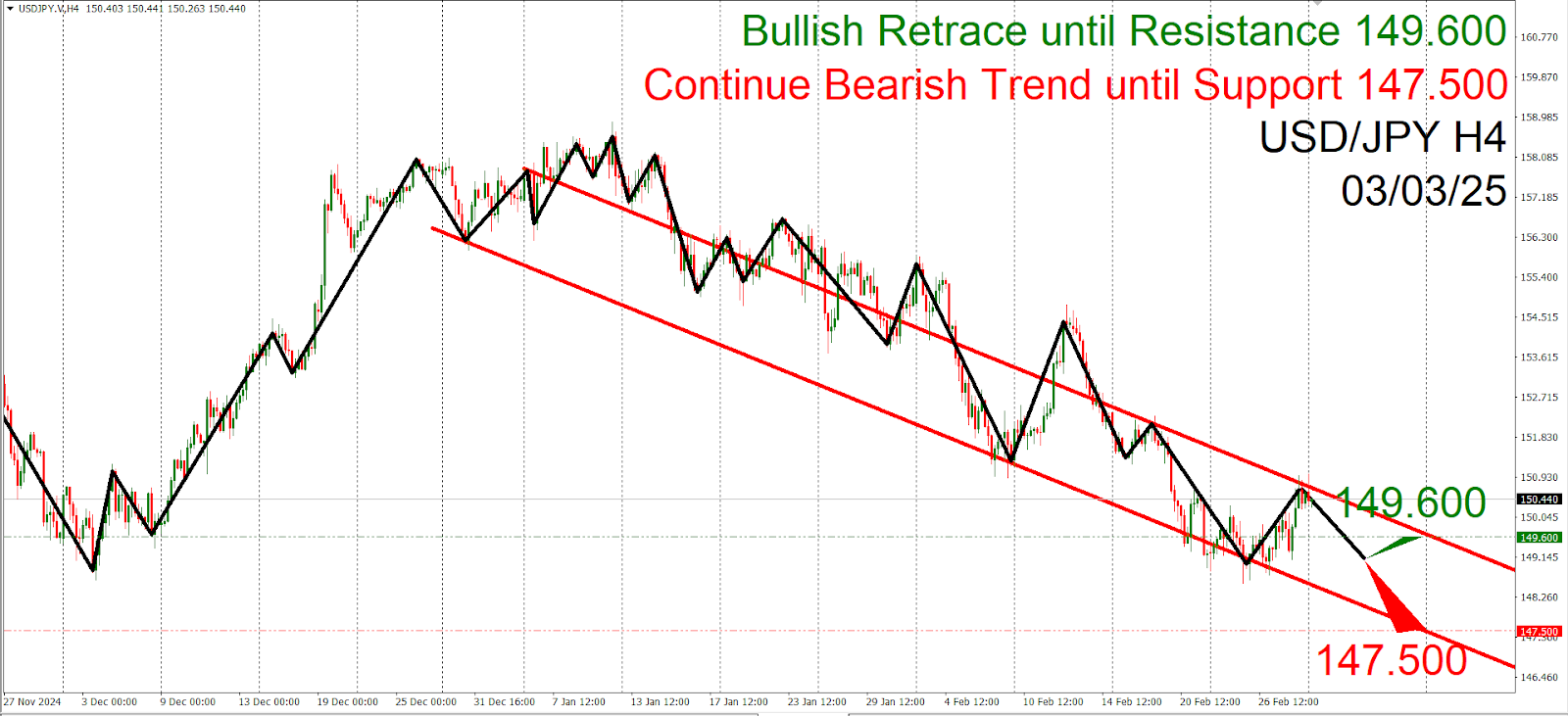

USD/JPY (H4) – March 3, 2025

The USD/JPY pair is showing bearish momentum, with key resistance and support levels to watch for potential trading opportunities.

- Trend: Bearish 📉

- Resistance: 149.600

- Support: 147.500

- Trading Outlook: If the price fails to break above 149.600, a downtrend toward 147.500 is likely. However, if it breaks above 149.600, a bullish reversal may begin.

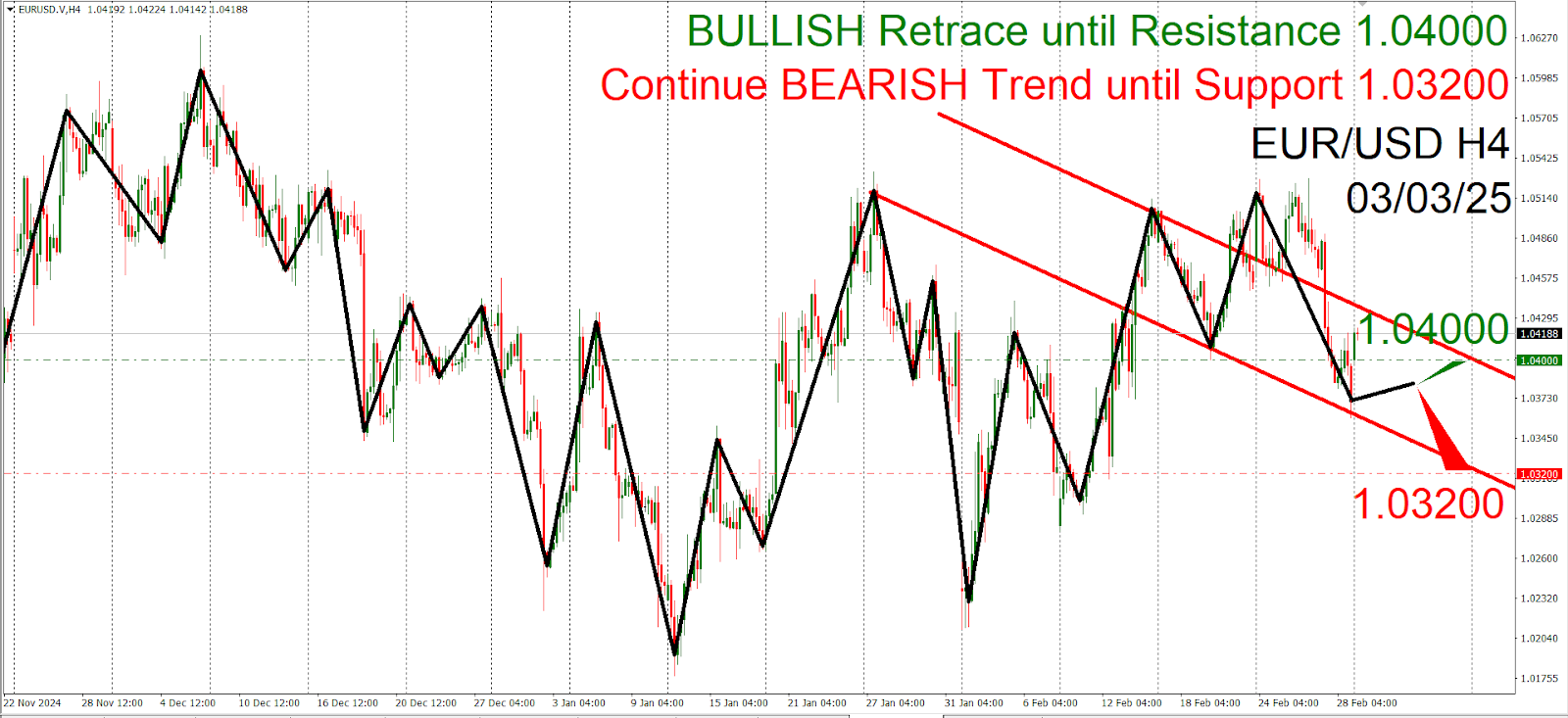

EUR/USD (H4) – March 3, 2025

EUR/USD remains in a bearish trend, with resistance and support zones that could define its next move.

- Trend: Bearish 📉

- Resistance: 1.04000

- Support: 1.03200

- Trading Outlook: If the price remains below 1.04000, selling opportunities exist. A break above 1.04000 could signal a bullish trend reversal.

XAU/USD (Gold H4) – March 3, 2025

Gold prices are trending downward, with resistance and support levels shaping potential trading strategies.

- Trend: Bearish 📉

- Resistance: 2870.00

- Support: 2810.00

- Trading Outlook: If the price fails to break above 2870.00, the bearish trend will likely continue. A breakout above 2870.00 may indicate a bullish reversal.

Understanding fundamental and technical analysis can help you make informed trading decisions. With insights into AUD, JPY, EUR, GBP, CAD, and USD, you can better anticipate market trends and seize trading opportunities.

Stay ahead of the market with Vestrado! Get the latest analysis and expert insights to boost your trading confidence and profitability. Join us now and trade smarter!